Orientation note: This page describes ASCOT’s behaviour across market regimes for benchmarking context only.

It does not present performance targets, index levels, or investment outcomes.

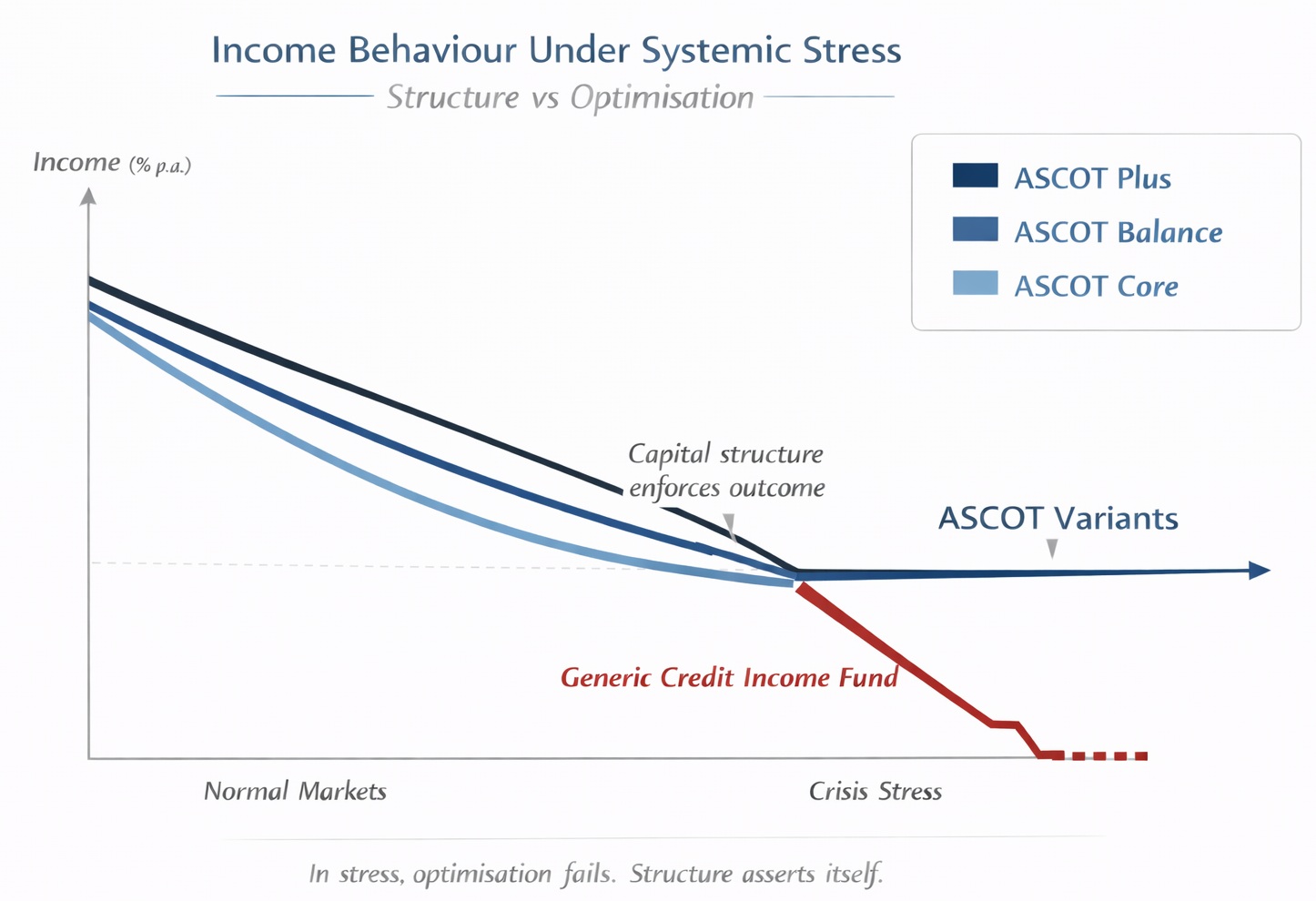

Most income benchmarks are built to look sensible in calm markets. ASCOT is built to remain intelligible when markets are not.

ASCOT measures securitised credit exposure by capital position — not optimisation, manager discretion, or yield targeting.

ASCOT is administered under a documented governance framework designed to preserve benchmark integrity, stability, and replicability for licensed users. ASCOT is a benchmark framework (not a product).

Oversight of index calculation, methodology maintenance, and licensing administration under documented procedures.

Formal review process governing eligibility interpretation, successor references, and methodology amendments.

Separation of benchmark administration from any investment product referencing ASCOT.

Material changes follow formal notice, versioning, and documentation protocols.

Securitisation is governed by contractual waterfalls. Cashflows do not depend on trading activity — they depend on priority of claim. ASCOT reflects this reality through fixed capital-stack exposure.

Detailed yield mechanics, illustrative stress analyses, and variant behaviour across market regimes form part of ASCOT’s licensed technical materials.

Request Access